CHICAGO – May 5, 2021 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the first quarter ended March 31, 2021.

Q1 2021 Highlights:

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

Management Commentary

Eddie Lehner, Ryerson’s President and Chief Executive Officer, said, “I want to thank my Ryerson teammates for performing exceedingly well in the first quarter of 2021 as we built upon improving demand and self-help initiatives and delivered higher Adjusted EBITDA, excluding LIFO than the full-year 2020 with exceptional asset management and expense leverage. I also want to thank our customers whose business we never take for granted and our suppliers for their support during what continues to be a time of market modulations without precedent or peer. Despite ongoing risks and challenges presented by the COVID-19 pandemic, Ryerson is harvesting the benefits of its improved operating model while further strengthening its balance sheet with opportunities to accelerate debt reduction in firm sight. We share a collective gratitude of working safely and together as we navigate through year two of the pandemic. We continue to invest in digitalization, value-add capabilities and Ryerson’s organizational culture to drive consistently great customer experiences at speed and scale across our intelligently interconnected metals service center network.”

First Quarter Results

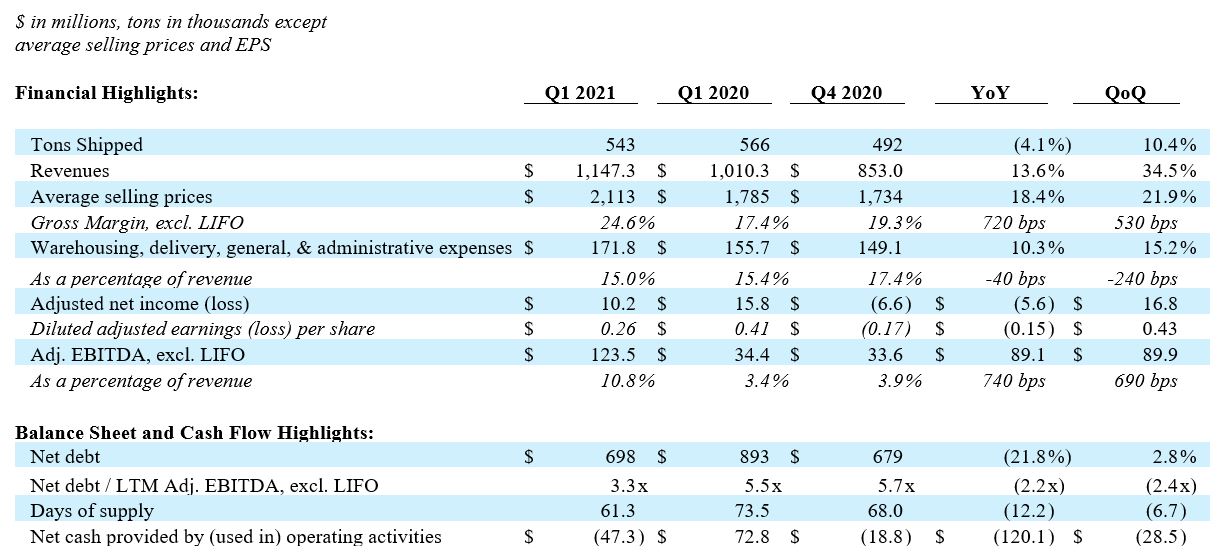

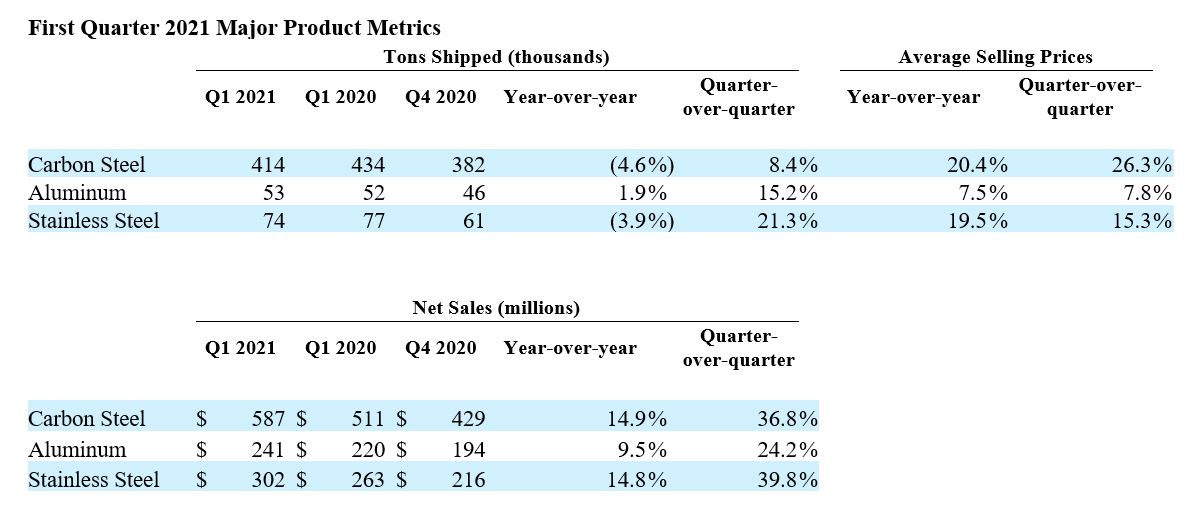

Ryerson achieved revenues of $1.15 billion in the first quarter of 2021, an increase of 13.6 percent compared to $1.01 billion for the first quarter of 2020, with average selling prices 18.4 percent higher and tons shipped 4.1 percent lower. On a per day basis, tons shipped declined by 2.5 percent year-over-year. Gross margin contracted to 17.2 percent due to higher cost of goods sold recognition, compared to 18.0 percent for the fourth quarter of 2020 and 19.4 percent for the first quarter of 2020. Included in first quarter of 2021 cost of materials sold was LIFO expense of $83.8 million, compared to LIFO expense of $10.7 million in the fourth quarter of 2020, and LIFO income of $20.2 million in the first quarter of 2020. Removing the impact of LIFO, gross margin expanded to 24.6 percent in the first quarter of 2021 compared to 19.3 percent in the fourth quarter of 2020 and 17.4 percent in the first quarter of 2020. A reconciliation of gross margin, excluding LIFO to gross margin is included below in this release.

In the first quarter of 2021, warehousing, delivery, selling, general, and administrative expenses increased by $16.1 million, or 10.3 percent compared to the same quarter last year, driven primarily by higher variable incentive compensation. However, Ryerson achieved expense leverage in the first quarter of 2021 as warehousing, delivery, selling, general, and administrative expenses decreased as a percentage of sales to 15.0 percent compared to 15.4 percent in the first quarter of 2020 and 17.4 percent in the fourth quarter of 2020.

Net income attributable to Ryerson Holding Corporation for the first quarter of 2021 was $25.3 million, or $0.66 per diluted share, compared to net income of $16.4 million, or $0.43 per diluted share, for the year-ago period. Included in first quarter 2021 net income is a gain on the sale of assets of $20.3 million. Adjusted net income attributable to Ryerson Holding Corporation, excluding the gain on sale of assets and the associated income taxes was $10.2 million for the first quarter of 2021, or $0.26 per diluted share compared to $15.8 million of adjusted net income, or $0.41 per diluted share, in the year-ago period. Additionally, due to the extreme commodity environment of the first quarter, the impact of LIFO cost of goods sold recognition was greater than anticipated. Adjusted net income attributable to Ryerson Holding Corporation excluding the impact of actual LIFO expense exceeding our fourth quarter LIFO expense estimate and the associated income taxes was $34.6 million, or $0.90 per diluted share. Ryerson achieved Adjusted EBITDA, excluding LIFO of $123.5 million in the first quarter of 2021, an increase of $89.1 million compared to the first quarter of 2020 and an increase of $89.9 million compared to the fourth quarter of 2020. A reconciliation of Adjusted net income (loss) to net income (loss) attributable to Ryerson Holding Corporation and Adjusted EBITDA, excluding LIFO to net income (loss) attributable to Ryerson Holding Corporation is included below in this news release.

Liquidity & Debt Management

Ryerson’s inventory days of supply decreased to 61 days as of the end of the first quarter of 2021, reflecting the improving demand conditions and simultaneous supply-side tensioning. This compares to 68 inventory days of supply for the fourth quarter of 2020 and 74 inventory days of supply for the same quarter last year. The Company continued to improve receivables and payables cycles in the first quarter, contributing to a cash conversion cycle of 53 days for the period, compared to 62 days for the fourth quarter of 2020 and 77 days for the year-ago period.

Ryerson’s use of operating cash in the first quarter of $47.3 million was driven by working capital investments and pension contributions. This compares to a use of operating cash of $18.8 million in the fourth quarter of 2020 and generation of $72.8 million in the year-ago period. In the first quarter of 2021, the Company sold its Renton, Washington facility, generating net proceeds of $26.3 million and recording a $20.3 million gain on the sale. Compared to the first quarter of 2020, the Company reduced total debt by $354.7 million, or 32.4%, lowering its leverage ratio to 3.3x versus 5.5x a year ago. Ryerson’s global liquidity rose during the period from $373 million as of December 31, 2020 to $583 million as of March 31, 2021 as the Company’s Adjusted EBITDA, excluding LIFO and working capital assets rose in value consistent with higher underlying commodity drivers and recovering demand.

Jim Claussen, Executive Vice President & Chief Financial Officer said, “Ryerson’s first quarter results highlight our teams’ ability to expertly manage our working capital assets throughout this extraordinary environment. The fruits of our balance sheet transformation achievements were also exhibited in our results as our leverage multiple decreased toward our target of 1 to 3x and our net book value of equity increased to $175 million driven by our net income generation and significantly decreased cash interest expense.”

Outlook Commentary

Although pandemic driven uncertainties persist, Ryerson is optimistic about the second quarter industry environment. At this point in the second quarter, demand fundamentals have continued to improve while supply-side constraints remain, resulting in price durability in all three of Ryerson’s primary commodities. Given these factors, Ryerson anticipates second quarter 2021 revenues in the range of $1.32 billion to $1.34 billion driven by sequential average selling prices growth of 12 to 14 percent and shipment growth of 1 to 3 percent. LIFO expense in the second quarter is expected to be in the range of $74 to $78 million as average inventory costs continue to rise. Therefore, Adjusted EBITDA, excluding LIFO is expected to be in the range of $131 to $135 million and earnings per diluted share are expected to be in the range of $0.49 to $0.60. A reconciliation of Adjusted EBITDA, excluding LIFO to net income is included below in this news release.

Earnings Call Information

Ryerson will host a conference call to discuss its first quarter results Thursday, May 6, 2021 at 10 a.m. Eastern Time. Participants may access the conference call by dialing 888-254-3590 (U.S. & Canada) / 929-477-0448 (International) and using conference ID 3582914. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 3,900 employees in approximately 100 locations. Visit Ryerson at www.ryerson.com.

Safe Harbor Provision

Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2020, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

Media and Investor Contact

Justine Carlson

312.292.5130

investorinfo@ryerson.com

For full release details see ir.ryerson.com.