CHICAGO – October 30, 2023 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the third quarter ended September 30, 2023.

Highlights:

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

Management Commentary

Eddie Lehner, Ryerson’s President and Chief Executive Officer, said, “I want to thank all of my Ryerson teammates for their continued efforts creating and sustaining a safe and productive operating environment. Additionally, I want to thank our customers for affording us the opportunity to contribute as an integral part of their supply-chains, which we never take for granted. Counter-cyclical conditions that emerged in the second quarter of 2023 continued to impact our industry during the third quarter, highlighted by shifting consumer spending patterns, higher interest rates, tightening credit conditions, decelerating manufacturing activity, as well as global economic slowing particularly in Europe and China. Prices across our product mix decreased during the quarter, while lower transactional customer quoting activity and reduced OEM customer order sizes put downward pressure on average selling prices and compressed gross margins. Despite unfavorable market conditions, we generated cash from operations and working capital release, reduced net debt, reduced costs, provided returns for shareholders, invested in growth through the acquisition of Norlen Incorporated in early October, and continued start-up activities at our new service centers in University Park, Illinois, Las Vegas, Nevada and the expansion of our service center in Shelbyville, Kentucky. While we navigated the cyclical headwinds during the quarter, we continued to improve our operating model by investing in systems technologies, expanding value-added capabilities and implementing efficiencies to position our business for long-term growth. As we look towards the fourth quarter and into 2024, our current investments in our physical and digital network position Ryerson well for both the next upturn and expected longer-term secular growth drivers in North American manufacturing activity.”

Third Quarter Results

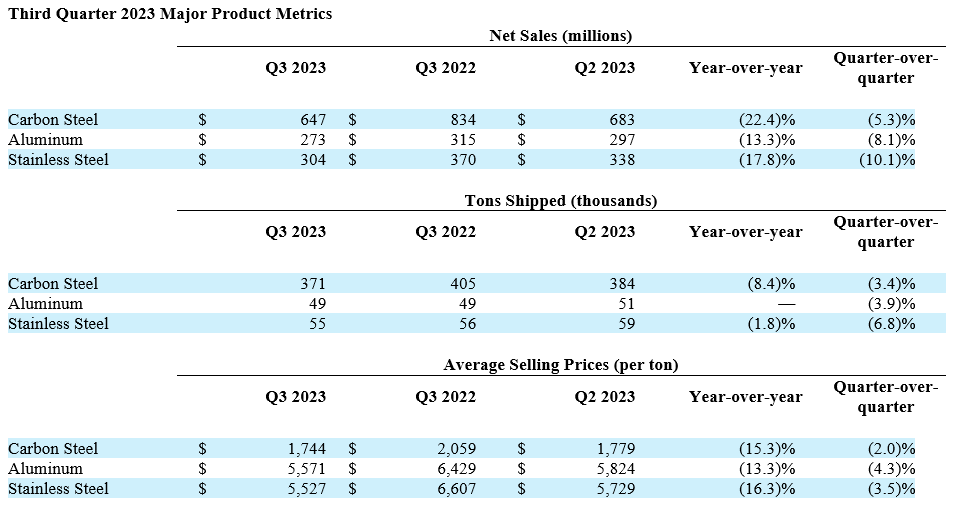

Ryerson generated net sales of $1.2 billion in the third quarter of 2023, a decrease of 7.2% compared to the second quarter of 2023. Net sales during the period were influenced by sequentially lower volumes and average selling prices, which decreased 3.6% and 3.7%, respectively, compared to the second quarter of 2023.

Gross margin expanded sequentially by 60 basis points to 20.0% in the third quarter of 2023, compared to 19.4% in the second quarter. Gross margins reflected LIFO income of $33.4 million, as the commodity price curves for our metals products sales mix decreased.

Excluding the impact of LIFO, gross margin contracted 140 basis points to 17.3% in the third quarter of 2023, compared to 18.7% in the second quarter. The compression in gross margins, excluding LIFO, was primarily driven by a decrease in prices across our product mix coupled with continued above normal inventories in the channel that put downward pressure on average selling prices. Warehousing, delivery, selling, general and administrative expenses decreased 4.7% to $193.0 million in the third quarter, compared to $202.6 million in the second quarter, primarily driven by lower variable expenses, lower accruals for personnel related expenses, and lower professional fees, partially offset by higher reorganization expenses related to an ERP systems implementation and start-up costs associated with the University Park service center.

Net income attributable to Ryerson Holding Corporation for the third quarter of 2023 was $35.0 million, or $1.00 per diluted share, compared to net income of $37.6 million, or $1.06 per diluted share in the previous quarter. Ryerson generated Adjusted EBITDA, excluding LIFO of $45.0 million in the third quarter of 2023, compared to the second quarter Adjusted EBITDA, excluding LIFO of $70.1 million.

Liquidity & Debt Management

Ryerson generated $79.3 million of cash from operations in the third quarter of 2023, supported by net income attributable to Ryerson Holding of $35.0 million and working capital release of $15.1 million. The Company ended the third quarter of 2023 with $366 million of debt and $329 million of net debt, a sequential decrease of $30 million and $37 million, respectively, compared to the second quarter. Ryerson’s leverage ratio as of the third quarter was 1.4x, which remains unchanged from the previous quarter and within the Company’s target leverage range. Ryerson’s global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, was $807 million as of September 30, 2023.

Shareholder Return Activity

Dividends. During the third quarter of 2023, Ryerson paid a quarterly dividend in the amount of $0.1825 per share, amounting to a cash return of approximately $6.3 million. On October 30, 2023, the Board of Directors declared a quarterly cash dividend of $0.1850 per share of common stock, payable on December 14, 2023, to stockholders of record as of November 30, 2023.

Share Repurchase. Over the course of the third quarter of 2023, the Company repurchased 133,094 shares for $4.0 million in the open market. Ryerson made these repurchases in accordance with its share repurchase authorization, which allows the Company to acquire up to an aggregate amount of $100.0 million of the Company’s common stock through April of 2025. As of September 30, 2023, $45.7 million of the $100.0 million remained under the existing share repurchase authorization. In total, Ryerson returned to shareholders $10.3 million in the third quarter of 2023.

Outlook Commentary

For the fourth quarter of 2023, Ryerson expects normal industry seasonal demand conditions, with customer shipments expected to decrease approximately 4% to 7%, quarter-over-quarter. The Company anticipates fourth-quarter net sales to be in the range of $1.00 to $1.15 billion, with average selling prices decreasing 3% to 5%. LIFO income in the fourth quarter of 2023 is expected to be $8 to $12 million. We expect adjusted EBITDA, excluding LIFO in the range of $28 million to $32 million and earnings per diluted share in the range of $0.18 to $0.22.

Earnings Call Information

Ryerson will host a conference call to discuss third quarter 2023 financial results for the period ended September 30, 2023, on Tuesday, October 31, 2023, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,300 employees in approximately 100 locations. Visit Ryerson at www.ryerson.com.

Manager - Investor Relations:

Pratham Dear, Manager - Investor Relations

312.292.5033

Notes:

1For EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding LIFO please see Schedule 2

2Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit, and is not soliciting, any action with respect to any Security or any other contractual relationship with Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to U.S. persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events, including Russia’s invasion of Ukraine and global trade sanctions; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the ownership of a significant portion of our equity securities by a single investor group; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2022, our quarterly report on Form 10-Q for the quarter ended September 30, 2023 and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

For full release details see ir.ryerson.com.